This book is published by Liberty Fund, Inc., a foundation established to encourage study of the ideal of a society of free and responsible individuals.

The cuneiform inscription that serves as our logo and as the design motif for our endpapers is the earliest-known written appearance of the word “freedom” (amagi), or “liberty.” It is taken from a clay document written about 2300 bc in the Sumerian city-state of Lagash.

© 2018 by Pacific Academy for Advanced Studies (PAAS).

Published by permission.

All rights reserved

Printed in the United States of America

18 19 20 21 22 c 5 4 3 2 1

18 19 20 21 22 p 5 4 3 2 1

Library of Congress Cataloging-in-Publication Data

Names: Alchian, Armen Albert, 1914– author. | Allen, William Richard, 1924– author. | Jordan, Jerry L., 1941– editor.

Title: Universal economics / Armen A. Alchian and William R. Allen ; edited by Jerry L. Jordan ; foreword by William R. Allen.

Description: Carmel, Indiana : Liberty Fund, Inc., [2018] | Includes bibliographical references and index. | Description based on print version record and CIP data provided by publisher; resource not viewed.

Identifiers: llcn 2017052105 (print) | lccn 2017054644 (ebook) | isbn 9781614876571 (Kindle) | isbn 9781614872818 (epub) | isbn 9781614879275 (pdf) | isbn 9780865979055 (hardcover : alk. paper) | isbn 9780865979062 (pbk. : alk. paper)

Subjects: lcsh: Economics.

Classification: lcc hb171.5 (ebook) | lcc hb171.5 .a339 2018 (print) | ddc 330—dc23

lc record available at https://lccn.loc.gov/2017052105

liberty fund, inc.

11301 North Meridian Street, Carmel, Indiana 46032-4564

CONCISE CONTENTS

- Detailed Contents vii

- Foreword xxiii

- part one: Demand, Exchange, and Property Rights

- 1 Welcome to Economics 3

- 2 Your Economic Society 15

- 3 Choice and Cost 33

- 4 Gains from Exchange 50

- 5 Demands and the Laws of Demand 62

- 6 The Extent of Exchange 81

- 7 Keep Your Eye on the Marginals 97

- 8 More Features of Demand 109

- 9 Some Implications of the Laws of Demand 125

- 10 Markets and Prices as Social Coordinators 133

- 11 Illustrative Applications of Demand Principles 146

- 12 Shortages, Surpluses, and Prices 157

- 13 Markets and Property Rights 171

- part two: Specialization, Production, Teams, and Firms

- 14 Productivity and Costs of Production 197

- 15 Specialization and Exchange 214

- 16 Market Supply and Price with Price-Takers 231

- 17 Timing of Adjustments 255

- 18 Facts of Life 274

- 19 Price-Searchers 285

- 20 Price-Searcher Pricing 310

- 21 Pricing and Marketing Tactics 324

- 22 Teamwork and Firms 344

- 23 The Firm’s Control and Reward Structure 363

- 24 Protecting Your Dependencies 376

- 25 Dependency Assurance by Reputation and Predictable Price 389

- 26 Prohibited Marketing Tactics 402

- 27 The Corporate Firm 420

- 28 Competition for Control of the Corporation 436

- 29 The Demand for Productive Resources 449

- part three: Wealth, Rates of Return, and Risk

- 30 Arithmetic of Capital Values 475

- 31 Series of Future Values and Annuities 490

- 32 Wealth, Income, and Interest 516

- 33 A Package Called the Rate of Interest 532

- 34 Risk and Insurance 543

- 35 The Full Equilibrium: Equalized Rates of Return 558

- 36 Determinants of the Interest Rate 571

- 37 Futures Markets 586

- part four: Employment and Inflation

- Glossary 681

- Index 693

DETAILED CONTENTS

- Concise Contents v

- Foreword, by William R. Allen xxiii

- part one: Demand, Exchange, and Property Rights

- 1 Welcome to Economics 3

- 2 Your Economic Society 15

- Rights and Property Rights 16

- Private Property Rights 17

- The Rule against Perpetuities 20

- Capitalist or Socialist 20

- Alert! Free Speech Is Not “Free Resources” 21

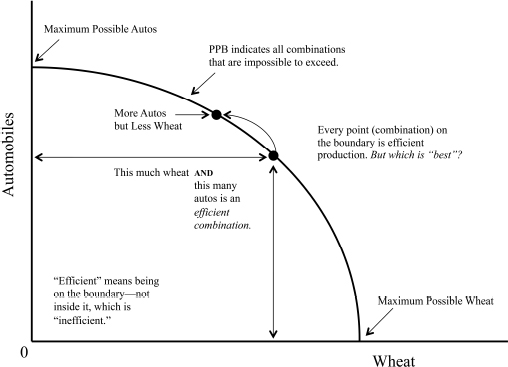

- Efficiency and the “Constrained Maximum” Concept 22

- Meaning of a “Theory” 24

- Economic Analysis Is Positive, Not Normative 24

- Increased or Reduced Probability and Refutable Implications 25

- Reported versus Verified Event 25

- Transient Lucky Event versus Basic Difference: The Ubiquitous Regression Effect 25

- Economics versus Economists 26

- Which Economic Theory? 26

- Economics and Biology 27

- The Basic Unit of Analysis Is the Individual, Not a Group 27

- Questions and Meditations 27

- 3 Choice and Cost 33

- Definition of Cost of a Chosen Action 33

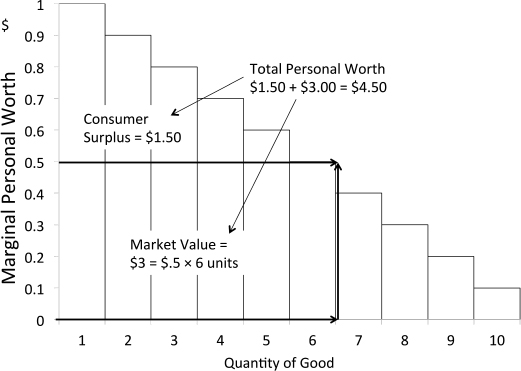

- Personal Worth 33

- Some Confusions That Must Be Avoided 34

- Externalities: Uncompensated Effects Borne by Other People 36

- Costs and Effects of Actions 36 Edition: current; Page: [viii]

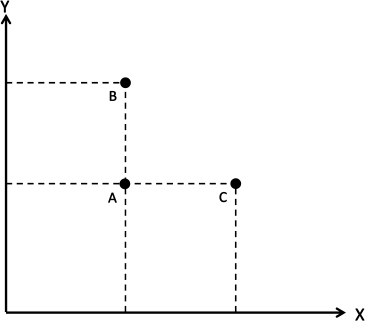

- Choices Reflect Principles of Personal Preferences 39

- The Personal Preference Principles 40

- Questions and Meditations 42

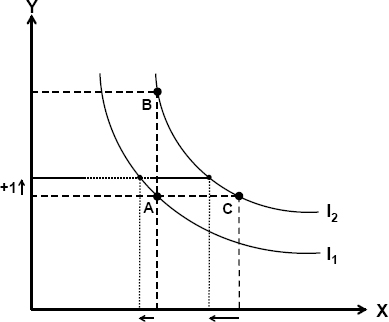

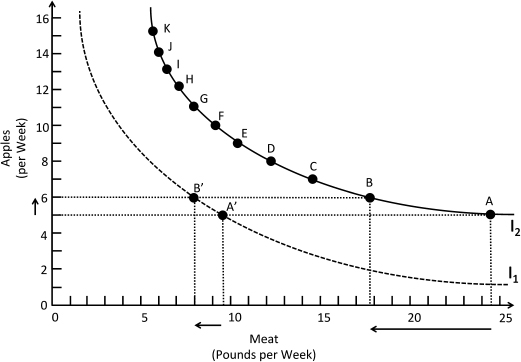

- Appendix to Chapter 3: Indifference Curves 44

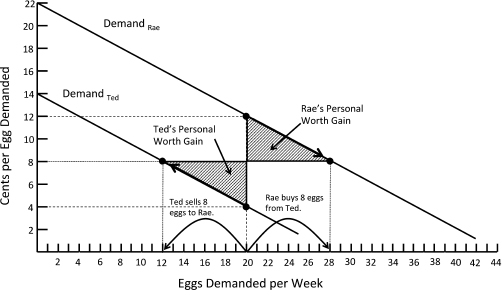

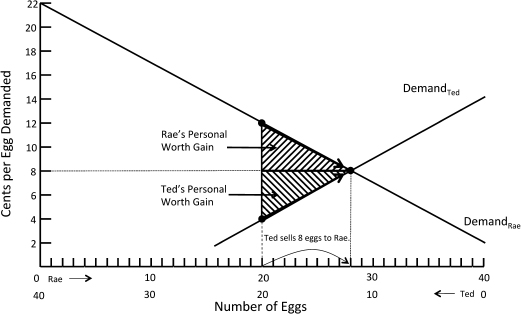

- 4 Gains from Exchange 50

- Trade in a Refugee Camp 50

- Less Is More: Fewer Goods, More Satisfaction 51

- Thinking about the Trade 52

- More about Personal Worth 53

- To Have? 54

- Back at the Refugee Camp, Competition Develops 54

- Promises and Dependencies 56

- Reliable General Dependency: Essential in Every Economy and Society 56

- Trade Benefits Both Parties, Not Just One at the Expense of the Other 57

- Questions and Meditations 57

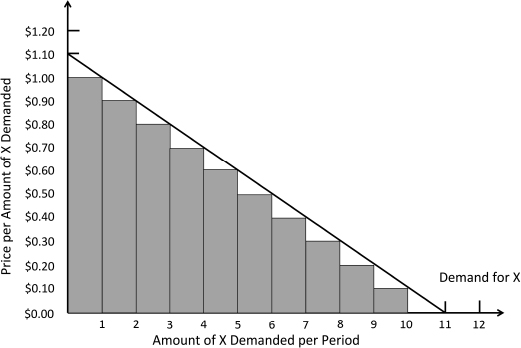

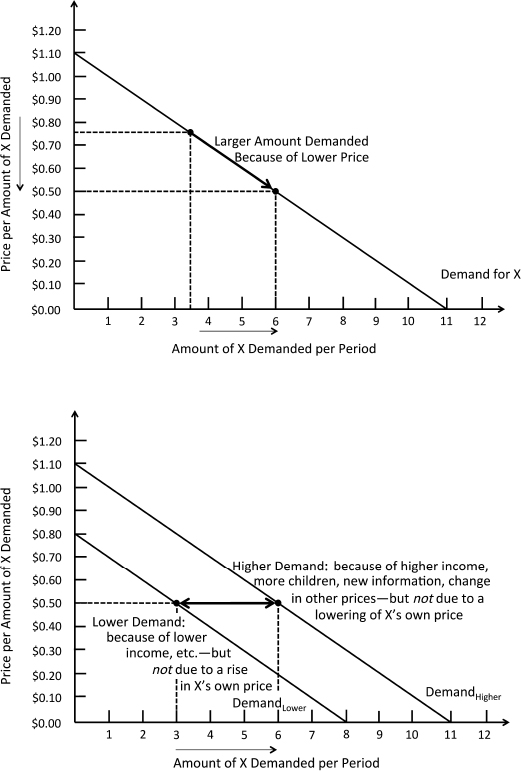

- 5 Demands and the Laws of Demand 62

- First Law of Demand 62

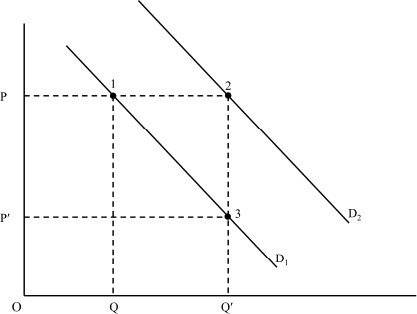

- “Quantity Demanded” versus “Demand” 63

- Negatively Sloped Demand 65

- Slide versus Shift 65

- Assumptions about Actions, Not about Thought Processes 66

- Direction of Relations, Not Exact Data, Is Pertinent 69

- Why So Much Concentration on “Marginals” Rather Than Totals or Averages? 71

- Dollar Price and Relative Price 72

- Meaning of “Change in Price” 73

- Suggestive Labels 74

- Questions and Meditations 75

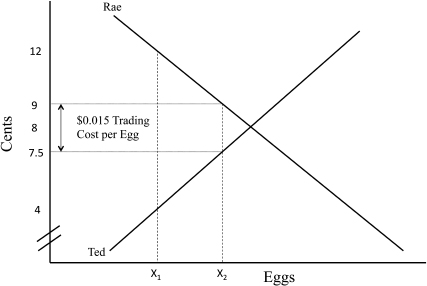

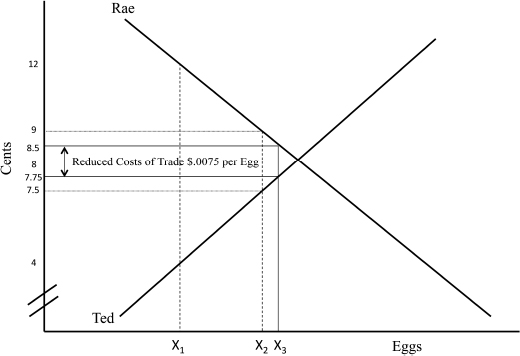

- 6 The Extent of Exchange 81

- Exchange 81

- Basis of National Policy on Market Competition 82

- Intermediaries and Transaction Costs 84

- Intermediaries’ Reduction of Full Price by Reducing Transaction Preparation Costs 85

- Markets: Open or Constrained Access? 88

- Markets—Everywhere 90

- Implications of Market Exchanges, Not Judgments 90

- Contracts and Reliable Promises: The Binding Forces of Society 91

- Questions and Meditations 92

- 7 Keep Your Eye on the Marginals 97

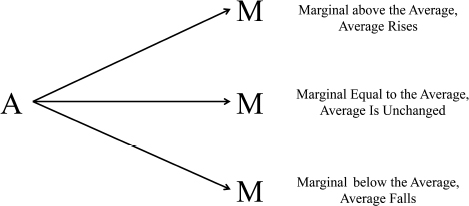

- Totals, Marginals, and Averages 97

- Cost 97

- Revenue 97

- Use the Marginal or the Average? 99

- Relations among Totals, Marginals, and Averages 99 Edition: current; Page: [ix]

- A Basic Principle: “The Equalization of Marginals at the Maximum Aggregated Return” 102

- Cost Minimizing 105

- Questions and Meditations 105

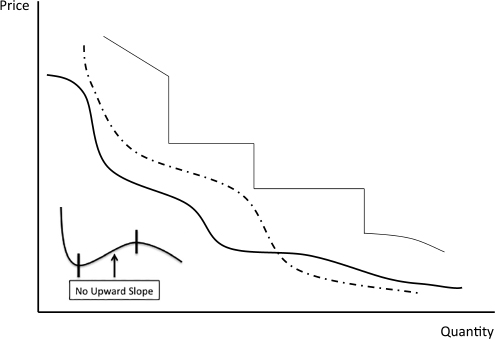

- 8 More Features of Demand 109

- Why So Much Attention to Price? 109

- Changes in Money Prices and Changes in Relative Prices 109

- Which Demand? 109

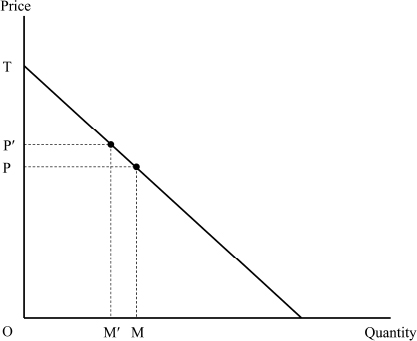

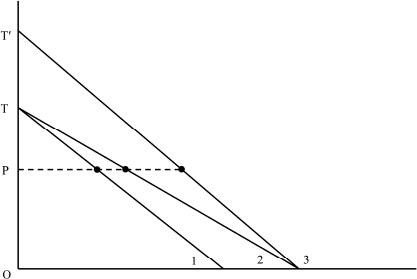

- Elasticities of Demand: Responsiveness of Quantity Demanded to the Price 110

- Remember: Elasticity of Demand Is a Measure of Movements along a Demand Schedule, Not a Result of a Shift in the Demand Schedule 115

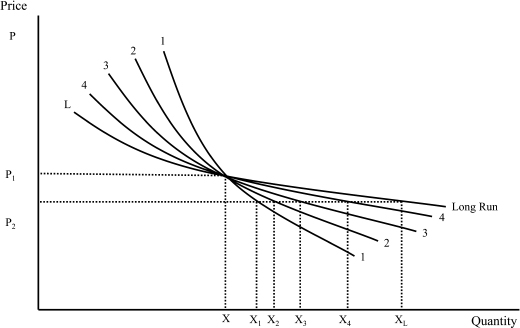

- The Second Law of Demand 116

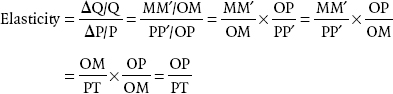

- A Fan of Demand Curves 118

- Income, Wealth, and Demand 118

- Wealth and Income Effects of a Change of Price 119

- Precisely What Is Meant by the Demanded Amount? 120

- Rate of Demand versus Aggregate Volume Demanded 120

- Questions and Meditations 121

- 9 Some Implications of the Laws of Demand 125

- 10 Markets and Prices as Social Coordinators 133

- A “Market-Clearing” Price? 133

- Market-Clearing Price for Allocation of a Fixed Supply of a Good 133

- “The Market” Sets the Price 134

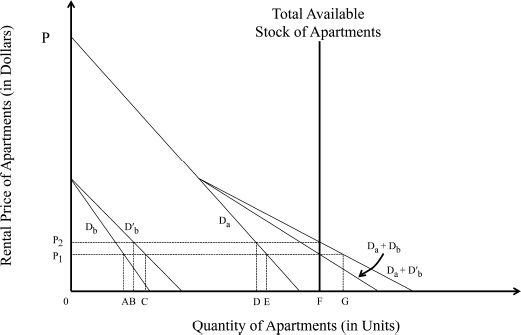

- The Market Demand: The Sums of the Individual Demands at Each Possible Price 134

- Irrelevance of Initial Allocation of Goods for Their Final Allocation to Highest-Valuing Users 135

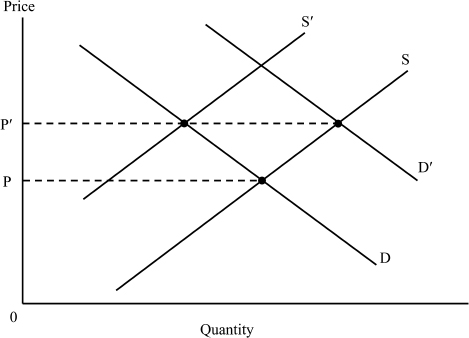

- Shortages Are Not Results of Reductions in Supply 136

- Markets and “Rights” 136

- Creation of Markets 137

- Reservation Demand to Own 137

- Rents 138

- Land Rent—A Pure Surplus? 138

- Quasi-Rent 139

- “Political Rent-Seeking” 139

- Questions and Meditations 141

- 11 Illustrative Applications of Demand Principles 146

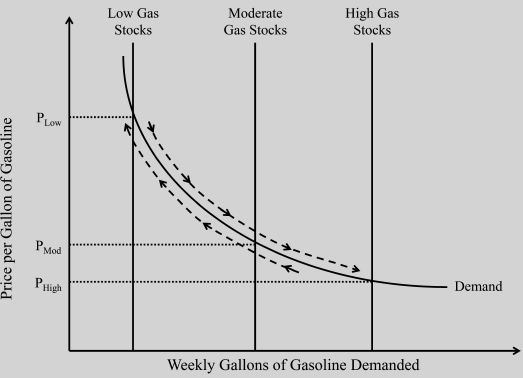

- Marketing Arrangements: Buffer Stocks, Reserve Capacity, Stable Prices, Waiting Times, and Price Response to Demand Uncertainty 146 Edition: current; Page: [x]

- Speed of Detecting Changes in Demand or Supply: The Illusion That Cost Determines Price 148

- Who Is Responsible for Higher Prices? Look in the Mirror 149

- What Made the Price Change? Always, the Initial Question 150

- Who Bears the Tax on Land Developments—Developers or Landowners? 150

- Tax on Economic Rent? 151

- Pollution and Land Values 151

- Questions and Meditations 153

- 12 Shortages, Surpluses, and Prices 157

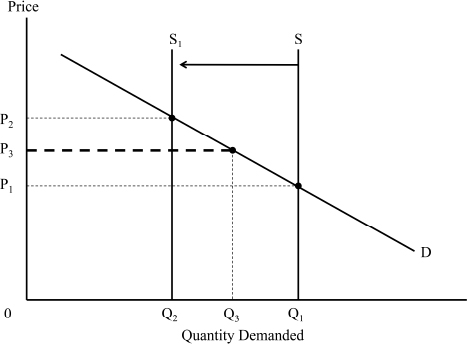

- Shortages and Price Ceilings 157

- Shifts to Nonprice Competition 158

- Wealth Transfers versus Costly Competitive Activity 159

- Rationing by Coupons 159

- Price Controls on Inputs (Petroleum) Do Not Reduce the Price of Outputs (Gasoline) 162

- Statement of a Basic Principle 162

- The Oil Industry Divided—Some Attacking and Others Defending Petroleum Price Controls 163

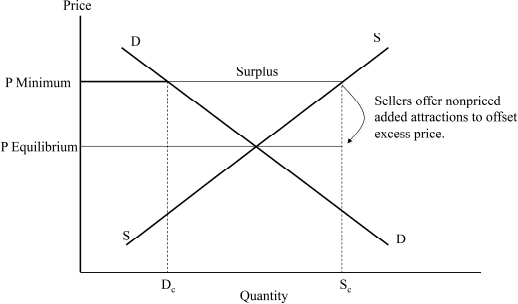

- Surpluses and Price Floors 164

- Competitive Behavior during a “Surplus” 166

- Implications 167

- Questions and Meditations 167

- 13 Markets and Property Rights 171

- How Relative Preferences Are Impressed on the Owner 172

- Government Agencies and Private Property Rights 172

- Two False Issues 175

- The Rule of Private Property Rights 176

- Protection and Preservation of Alienability 177

- Shared Ownership 177

- How to Become a Member-Owner? 178

- Why Deliberately Suppress Private Property Rights of a College? 179

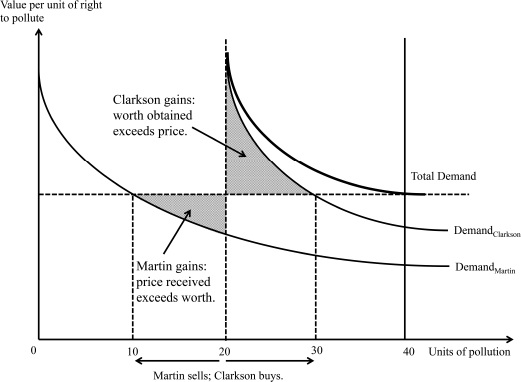

- Externalities 180

- “Public Goods” 181

- Government Control 182

- Public, or Group, Goods: Clubs 182

- Privately Supplied Public Goods Financed by Tie-Ins 183

- Charity 183

- Questions and Meditations 185

- part two: Specialization, Production, Teams, and Firms

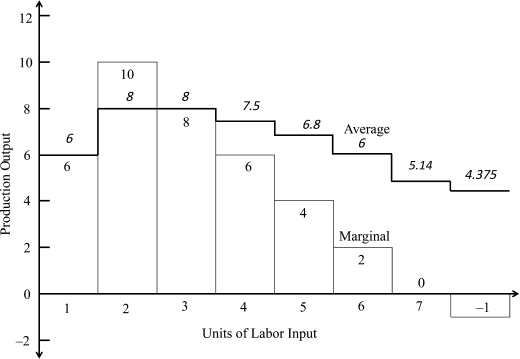

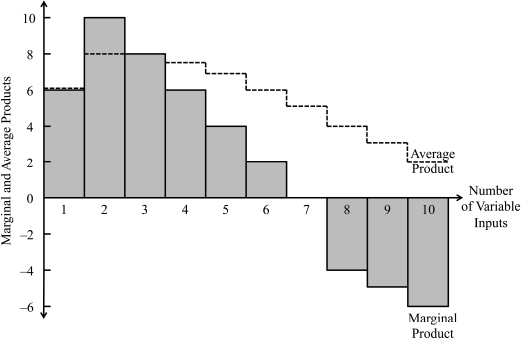

- 14 Productivity and Costs of Production 197

- Productive Ability versus Costs of Production, or Absolute Advantage versus Comparative Advantage 197

- Measure of Cost 197 Edition: current; Page: [xi]

- Costs versus Productive Ability 198

- No One Can Be the Lowest, or the Highest, Cost Producer of Every Good 198

- Absolute Productive Ability versus Lower Costs 198

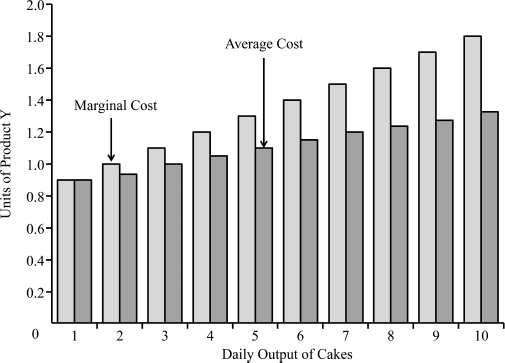

- Marginal and Average Costs 199

- Marginal Costs 199

- Temporary Simplifying Assumptions 199

- Ricardian Superiority and Ricardian Rent 199

- Rates versus Volume of Production: An Important Distinction 200

- Marginal and Average Costs and Their Realistic Relation to Rates of Production 200

- Arithmetic of Marginal Cost 202

- The Sum of the Marginal Costs Is the Total Cost 202

- The Marginal-Average Relationship 203

- Rate and Volumes of Production 203

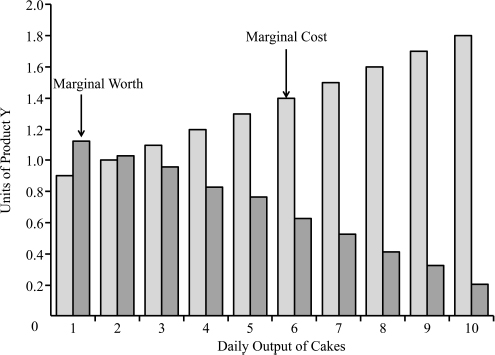

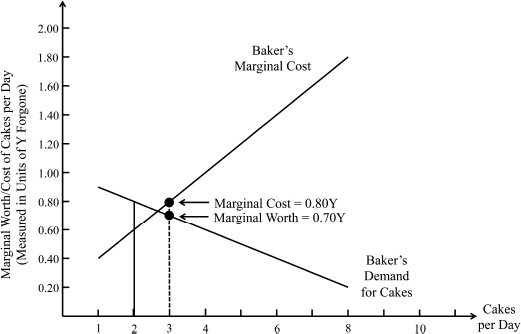

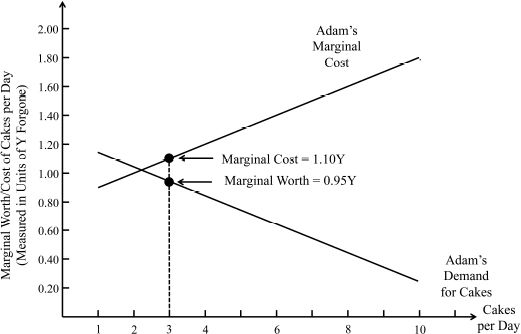

- Choice of Production and Consumption by Self-Sufficient Adam 203

- Marginal Costs Are Higher at Faster Rates of Production 204

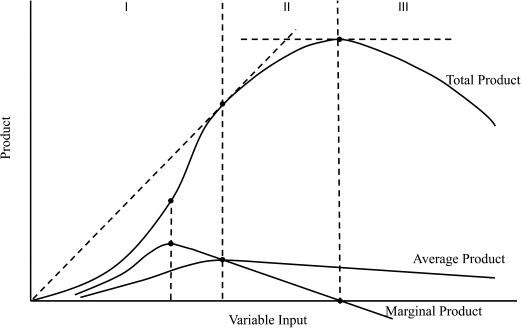

- The Law of Diminishing Marginal Returns 205

- Price of Labor versus Labor Cost of Output 206

- Questions and Meditations 207

- 15 Specialization and Exchange 214

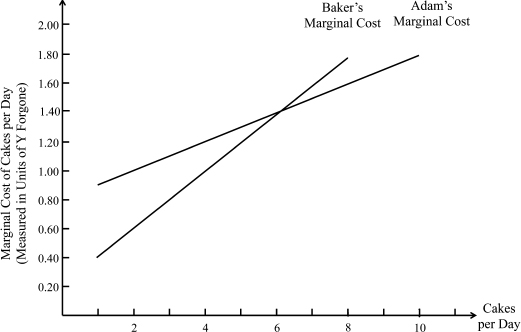

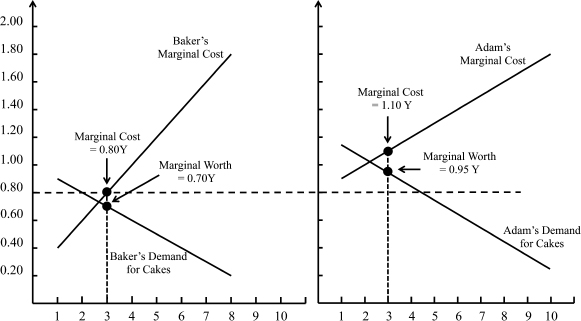

- Adam’s and Baker’s Production and Costs Compared 214

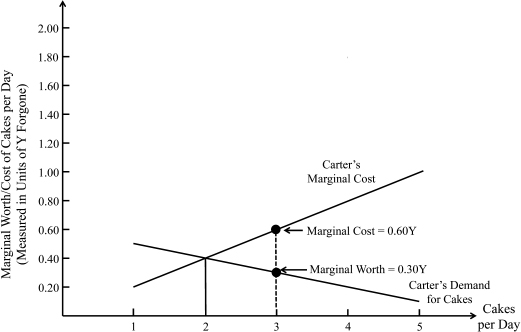

- Differences in Costs and Marginal Worths Create Opportunities for Trade 217

- Two’s Company, Three’s Even Better: Effects and Objections to New Entrants 218

- An Economically Complete Analysis 219

- Reduced Cost, Profit, and Dispersion of the Profit 221

- Improved Quality and the Dispersion of the Benefit 221

- Two Meanings of Specialization in Production and Several Sources of Benefits 223

- No Free Benefits: Increased Dependence 225

- Questions and Meditations 225

- 16 Market Supply and Price with Price-Takers 231

- Sunk Investment or Set-Up Cost 231

- What Rate of Production? 231

- Price-Taker/Sellers 232

- Price-Taker/Seller Sees a Horizontal Demand Curve at the Market Price 233

- No Rivalry among Price-Takers 233

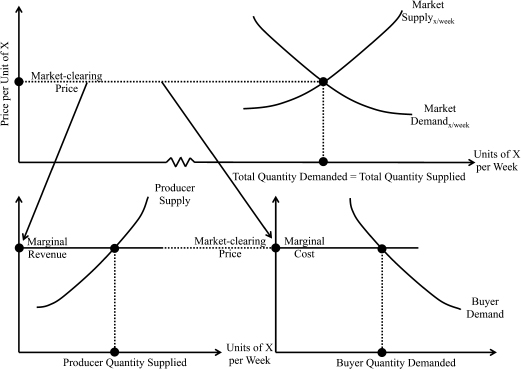

- Aggregated Demand and Aggregated Supply in the Market 234

- Marginal Costs, Profits, and a Price-Taker’s Supply Response to the Market Price: A Price-Taker’s Marginal Revenue Is Equal to the Market Price 235

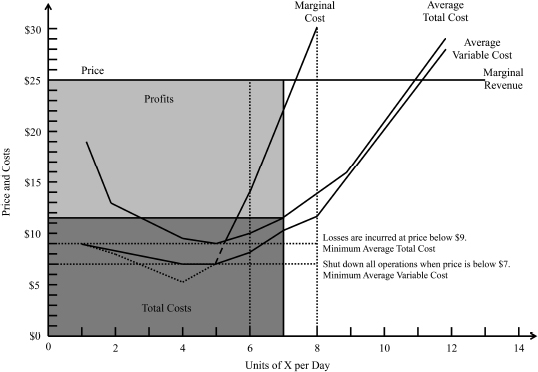

- Determining the Rate of Production and Supply 236

- Two Types of Constant Costs: 1) Constant Total Daily Costs Regardless of Daily Rate of Production (Even If Zero); 2) Constant Costs per Unit of Production 236

- The Planned Output Rate for Profit Maximizing 237

- A Graph Showing Price-Takers’ Response to the Market Price 238 Edition: current; Page: [xii]

- Profit-Maximizing Rates of Output at Other Market Prices 238

- Why Analyze Profit-Maximizing Rate of Production through Marginal Revenues and Marginal Costs? 239

- A Role for Average Cost 239

- The Long-Run Average Cost 240

- The Short-Run Average Cost 240

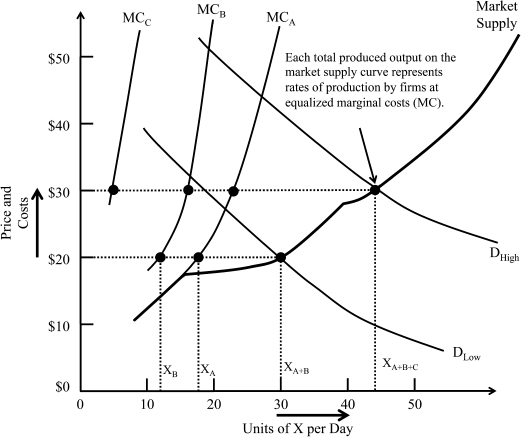

- Market Supply Curve of Price-Taker/Suppliers Is the Horizontal Sum of the Marginal Cost Curves 240

- An Upward-Sloping Market Supply Curve 241

- Industry-Wide Cost Minimization of the Profit-Maximizing Output 241

- Is the Profit Test of Survival “Socially Desirable”? 242

- Competition for Profitable Resources Converts Profit into Cost 243

- A Person, Rather Than Equipment, as the Responsible Resource 244

- Profits Are Increases in Wealth—Not Transfers of Wealth from One Person to Another 245

- Productive Resources That Enter after a New Tax 249

- Depreciation versus Capital Value Changes 249

- Obsolescence versus Depreciation 249

- Why Do Accounting Records Show Depreciation as Erosion of Initial Cost of Resource, Rather Than of Current Value? 250

- Questions and Meditations 250

- 17 Timing of Adjustments 255

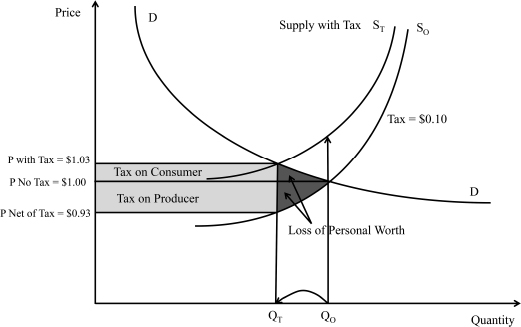

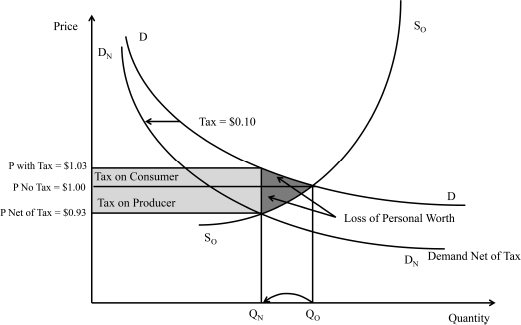

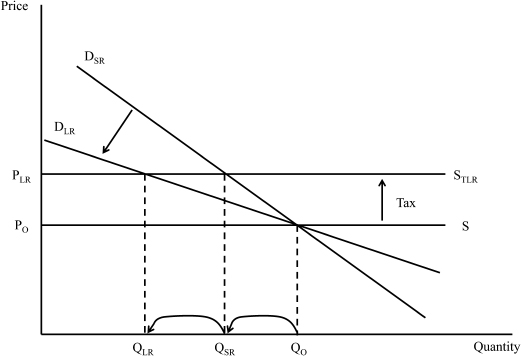

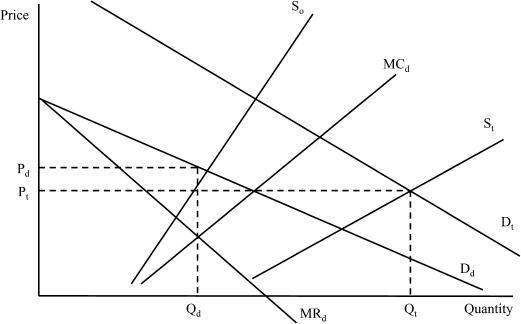

- Tax It: Demand and Supply 255

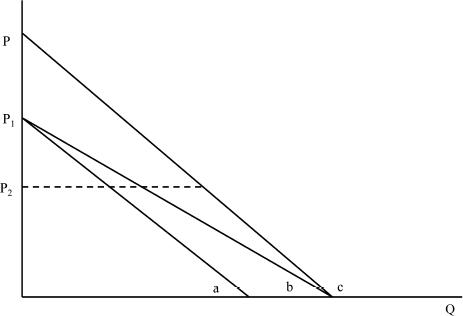

- Deadweight Welfare Loss 257

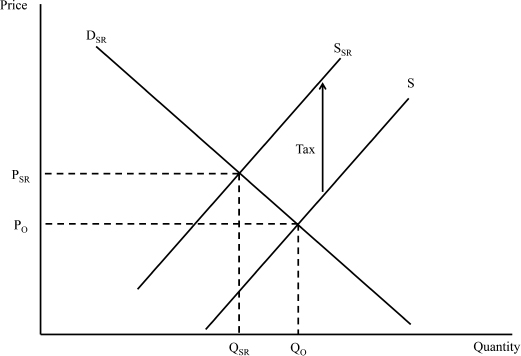

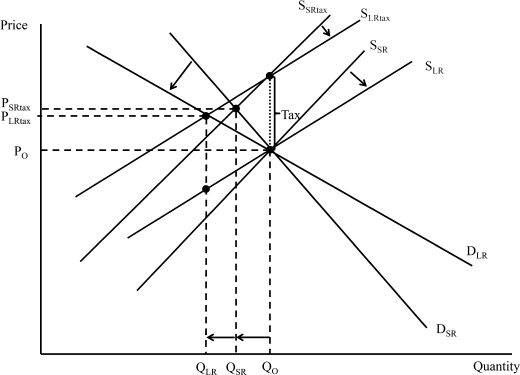

- Mobile versus Less-Mobile Resources 258

- Comparison of Short-Run and Long-Run Effects 258

- After the Long-Run Adjustments, Consumers Pay All the Tax; New Investors Pay None 260

- Only Present and Future Costs Are Really Costs 261

- Quasi-Rent: A Temporary Surplus 261

- Infinite Elasticity of Supply 262

- The Longer-Run Responses and Effects 262

- For What Is the Tax Used? 263

- Reducing Negative-Worth Externalities 264

- Adjustments before Predicted Event Occurs 264

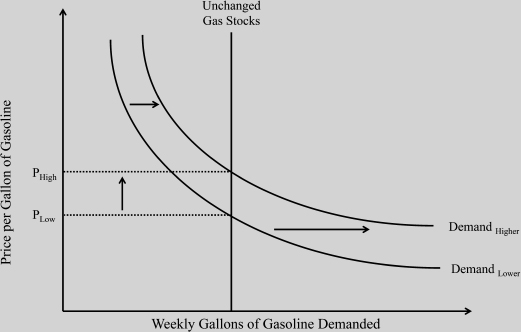

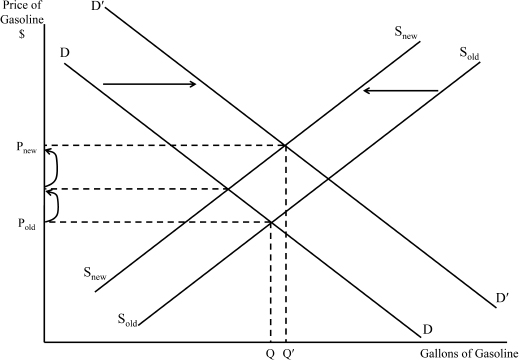

- Gasoline and Oil Prices 265

- Competitive Pricing Response to New Entrants: Is It Predatory? 267

- Questions and Meditations 270

- 18 Facts of Life 274

- The Missing Entrepreneur 275

- Example of Effect of Creative Destruction 276

- Many Producers of a Consumer Product 276

- Managers Don’t Know Their Costs as Accurately as Those Shown in the Examples 277

- Allocating Common Costs to Joint Products 278

- Supply in Terms of Mass Production and the Volume Produced 280 Edition: current; Page: [xiii]

- Summary of Cost and Volume Output Relations 281

- Warning 282

- Demand in Terms of Volume Demanded 282

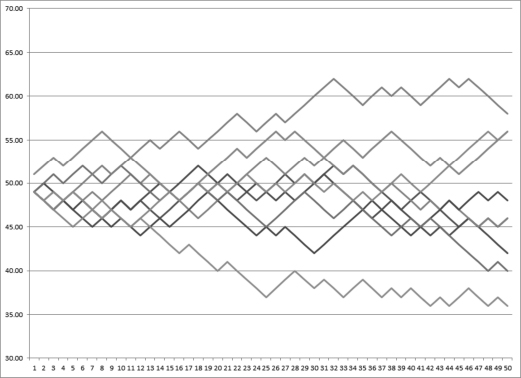

- The Historical Pattern of Prices of a Product 282

- Questions and Meditations 283

- 19 Price-Searchers 285

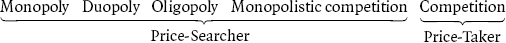

- Price-Takers and Price-Searchers 285

- Differences for Customers because of Differences among Competing Sellers 286

- Price-Searchers Search for the Best Price to Maximize Profits 286

- Price-Searchers Must Set the Prices for Their Products 287

- Signals to Price-Searchers 288

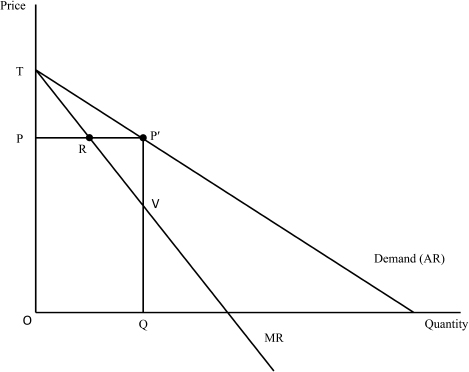

- Pricing at a Uniform Price to the Entire Public 288

- Price versus Marginal Revenue 288

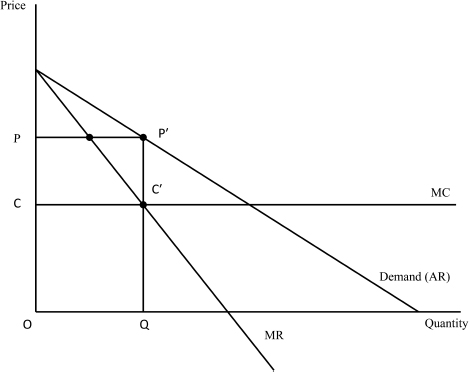

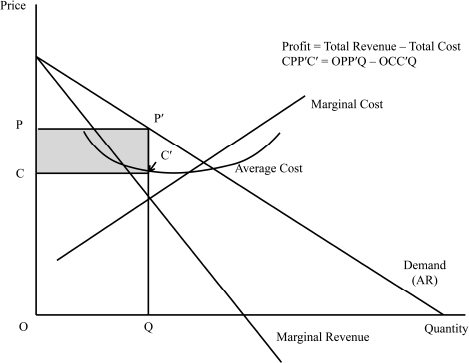

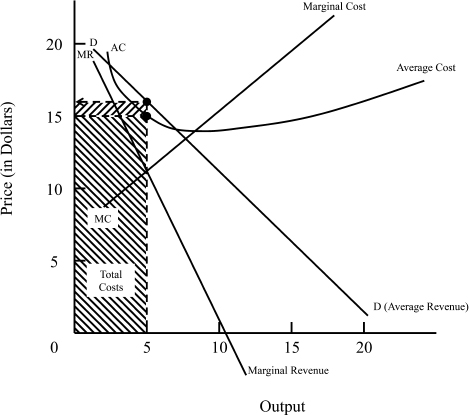

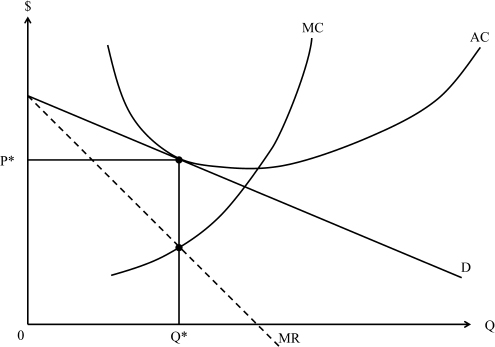

- The Profit-Maximizing Price and Quantity: Marginal Revenue Equality to Marginal Cost 289

- Price-Searcher with Increasing Marginal Costs 289

- Increasing Marginal Costs and the Profit-Maximizing Output 291

- Knowing Patterns of Marginal Costs and Marginal Revenues 291

- Sellers Aren’t Naive 292

- Closed, Restricted, and Open Markets 293

- Who Is Restricted by a Restriction on the Seller? 294

- Categories of Sellers 294

- Who Is a Monopolist? 295

- Cartels 296

- Personal Services? 296

- Objectives of the Language of Economics and the Language of Litigation 296

- Objections to (1) Closed Markets and (2) Price-Searchers in Open Markets 297

- Normative Standard for the Laws: Open Markets and Forgone Consumer Worth? 298

- “Monopoly” Distortion: Inefficient Output Ratio 298

- Is It Really Wasteful or Inefficient? 300

- Long-Run Response: Capacity and Cost Response to Demand Changes 300

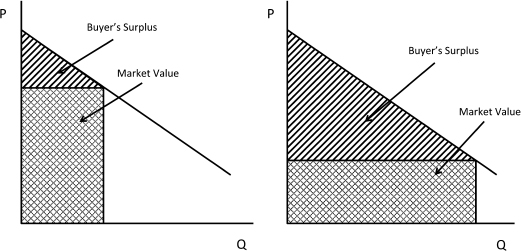

- The Meaning of Consumer Worth and to Whom It Belongs 302

- Questions and Meditations 303

- 20 Price-Searcher Pricing 310

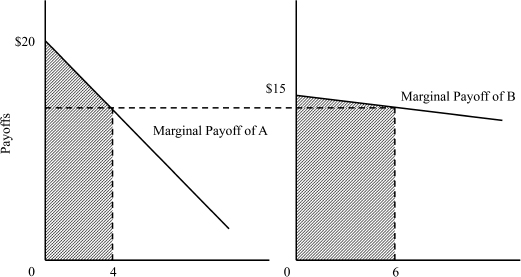

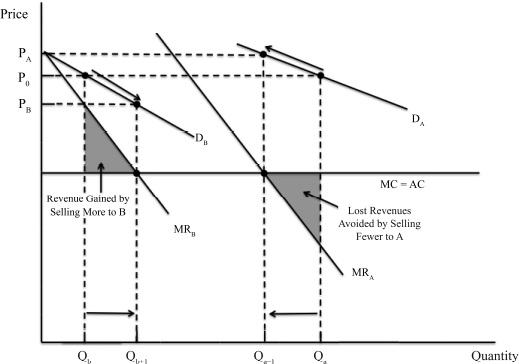

- Charging Different Prices among Customers to Equalize Marginal Revenues 310

- What Rate of Production? 311

- Marginal Revenue Equalization: Price Discrimination? 312

- Dumping Is Not Selling Below Cost. It’s Simply Marginal Revenue 313

- College Tuition Scholarships? 313

- Discount Coupons 314

- Free and Special Services: A Free Tie-In 314

- Is Marginal Revenue Equalization Really Price Discrimination? 314 Edition: current; Page: [xiv]

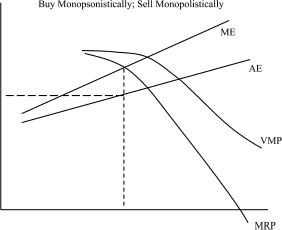

- Price-Searcher Buyer—Monopsonist 315

- Why Higher Wage Rates to All Employees? 316

- Differentiating Benefits 317

- Questions and Meditations 318

- 21 Pricing and Marketing Tactics 324

- Tie-Ins 324

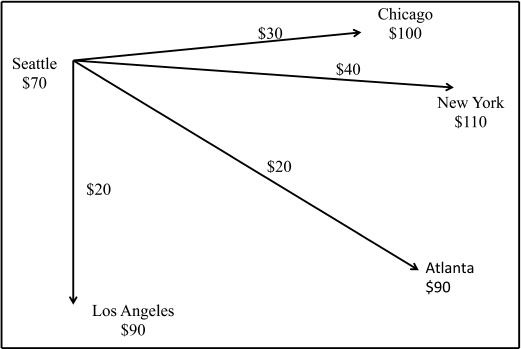

- Basing-Point Pricing 329

- Efficient, Competitive Pricing Response to New Entrants, Misconstrued as Predatory Pricing 331

- Dominant Firm, with Market Power 333

- Price Leaders? 336

- Oligopoly 336

- Networks, Monopoly Lock-Ins? 337

- Patents and Copyrights: Conflicting Objectives and Ambiguous Policies of Reward to Inventors 338

- Questions and Meditations 340

- 22 Teamwork and Firms 344

- No Definable, Separable, Individual Products for Each Team Member 344

- Intrateam Dependencies 345

- Are You Paid What You Add to the Total Value? A Futile Question 346

- Hazards to Effective, Viable Teams: Dependencies, Moral Hazard, Uncertainty of Team Value, and a Risk-Accepting Owner 347

- The Saga of Codlandia 348

- National Development 358

- Questions and Meditations 359

- 23 The Firm’s Control and Reward Structure 363

- The Boss 364

- What Is the Meaning of “Owning a Firm”? 364

- Management Rewards 365

- Shirking as Moral Hazard or Opportunistic Hold-Ups 366

- Monitoring and Deterring Shirking 366

- Loyalty and Shirking 366

- Customers, Rather Than the Employer, May Monitor and Restrain Employee Shirking: “Tips” 367

- Firms Not Owned by Full Private Property Rights 370

- Questions and Meditations 372

- 24 Protecting Your Dependencies 376

- Dependent Investments 376

- Integrated Ownership 377

- Reciprocal Dependency 378

- Exclusive Service Contracts to Protect Reliability and Investments in a Person 378

- Example: The Controversial Baseball Reserve Clause 379

- Voluntary Maximum Retail Price 379 Edition: current; Page: [xv]

- Publisher versus Distributor Conflict about Retail Price 380

- Integration? 380

- More Examples of Price Ceilings Imposed on Retail Distributors 381

- Minimum Permissible Retailer Prices, Known as Retail Price Maintenance (RPM), to Avoid Free Riding of Discounters 381

- Self-Enforcing Hostage Value That Depends on Performance 382

- The Case of Coors Beer: How a Manufacturer Enhances the Reliability of Distributors 383

- Exclusive Territories Protected by Resale Price Maintenance 384

- End of Coors Dominance—New Technology 384

- Government Regulation to Protect Dependent Customers of Closed Monopoly Supplier 384

- Public Utilities and Natural Monopolies 384

- Owning a Firm or Lending to It? 385

- Questions and Meditations 385

- 25 Dependency Assurance by Reputation and Predictable Price 389

- Brand Names: Reducing Costs of Prepurchase Information and Shopping 389

- Cost of Maintaining Brand-Name Value 389

- Reputation as Self-Enforcer of Reliability 390

- Franchises Rely on Reputation of Brand Names 390

- Hostages to the Franchiser to Assure Reliable Performance by the Franchisee 390

- Advertising—Reducing Search Costs 391

- Good Samaritan: Am I My Brother’s Keeper? 391

- Personal Shame 392

- The Value of Predictability of Price 392

- Predictability and Assurance of Future Prices 392

- Announcing Reliable Prices 394

- Voluntarily Tolerated Queues: Inventories and Rationing 394

- Preferred Customers among Those Who Differ in Volume and Rate of Demand 395

- No Surprise and No Haggling: Same Announced Price to All Customers 395

- Blind Blocks to Economize on Duplicative Inspection and Sorting 396

- Professional Codes of Ethics 398

- Questions and Meditations 398

- 26 Prohibited Marketing Tactics 402

- What Is Antitrust? 402

- The Clayton Antitrust Act of 1914 403

- The Federal Trade Commission Act of 1914 404

- Remedies and Enforcement Agencies 404

- Specialization and Dependency 404

- Meaning of a Benign and a Malign Effect? 405

- The Basic Criterion: Maximizing Consumer Worth 405

- Effects on Competitors 406

- Surrogate Criteria for Permissible Actions: Rule of Reason 407

- Per Se Illegality 407 Edition: current; Page: [xvi]

- Vertical or Horizontal Agreements 408

- Concentration Ratios 408

- Coalition versus Collusion 410

- Purpose of Collusion 411

- Obstacles to Effective Collusion 411

- Vulnerability of Government Agencies as Less-Careful Buyers 413

- Government-Enforced Cartels: For Whose Benefit? 413

- Farm Support Programs 414

- Labor Unions 415

- Politicians: Agents of the Public in the Competition for Government Aid 415

- Questions and Meditations 417

- 27 The Corporate Firm 420

- Forms of Ownership of Firms 420

- The Corporate Form of Business 420

- Shares of Ownership 421

- Management Structure 421

- Characteristics of Ownership of Corporations—Sharing in Large Investments 421

- Nondiscriminatory Sale of Shares of Ownership 421

- Evolution of the Corporate Ownership Structure 422

- Historical Evidence of the Effects of the Corporate Entity 423

- Legislation to Constrain Corporate Form of Organizations 424

- Differences between Large and Small Firms 424

- Why Very Large Firms? 425

- New Tax on Existing Corporations 427

- New Investments in Corporations after the Tax 427

- Questions and Meditations 428

- Appendix to Chapter 27: Interpreting Financial Statements 429

- 28 Competition for Control of the Corporation 436

- Who Owns the Corporation? 436

- Separation of Ownership from Control Can Be a Way to Specialize 437

- Control of Behavior of Manager by Owners: The Universal Moral Hazard Phenomenon 437

- Competition for Achievable Gains by Superior Control 438

- Obstacles to Stockholder Control of Management: Legislation 438

- Entrenched Management’s Resistance 439

- Displacement of Owners and Managers by New Sets of Owners and Managers by Purchase of Complete Ownership 439

- Takeovers Benefiting Stockholders by Transferring Wealth from Other Members of the Firm 441

- Indirect Takeovers 442

- Charity Is Better than Coercion 443

- Shareholders or Stakeholders? Promises and Agreements? 443

- Survival of the Corporate Organization 444

- Managers and Consumers 444

- Questions and Meditations 444

- 29 The Demand for Productive Resources 449

- Homogeneous, Uniform Units of a Productive Resource versus Nonuniform Units 449

- The Demand for Productive Services of Uniform Inputs 449

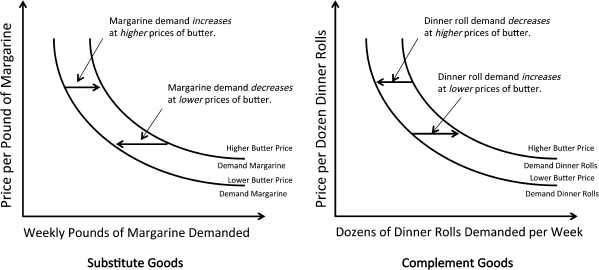

- The Long-Run Elasticity of Demand for Productive Inputs Exceeds the Short-Run Elasticity 453

- Cross-Price Elasticity of Demand for Productive Resources 454

- Input Substitutions in Production Caused by Consumer Substitutions among Consumer Goods 454

- Substitutes and Complements 454

- Generalization and Similarity to Demand for Consumption Goods 455

- Summary of Principles of Demand for Amounts of a Kind of Productive Resources 455

- Lagged Substitutions Tend to Be Veiled by Interim Events 455

- The Fallacy of Energy Efficiency—Other Inputs Are Not Free 456

- More Capital Increases Productivity, but Who Benefits? 456

- Labor and Capital: Is There a Real Difference? Is It Current versus Earlier Labor? 457

- Human Capital 457

- Social and Cultural Resources as Productive Inputs 458

- If Resources Are Not Owned, Less Attention Is Focused on Market Values 458

- A Market for Labor or a Market for Persons 458

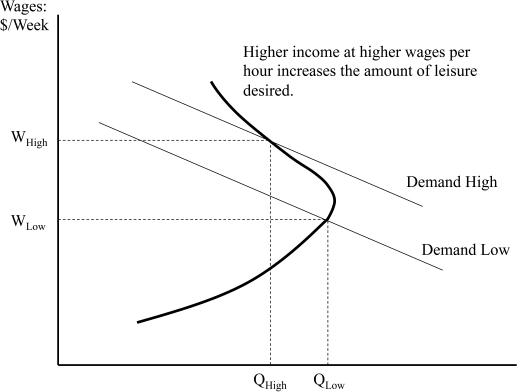

- Individual Supply of Labor 460

- What Is a Unit of Labor Service? The Value of the Service Is Critical 461

- Questions and Meditations 461

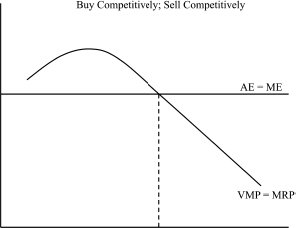

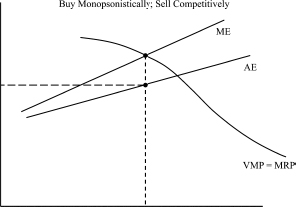

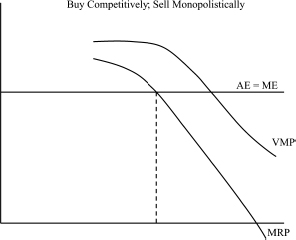

- Appendix to Chapter 29: Output and Input Equilibria of the Firm 468

- 14 Productivity and Costs of Production 197

- part three: Wealth, Rates of Return, and Risk

- 30 Arithmetic of Capital Values 475

- Essential Concepts for Your Future 475

- Current and Future Services of Durable Resources 475

- Principles of Capital Valuations 478

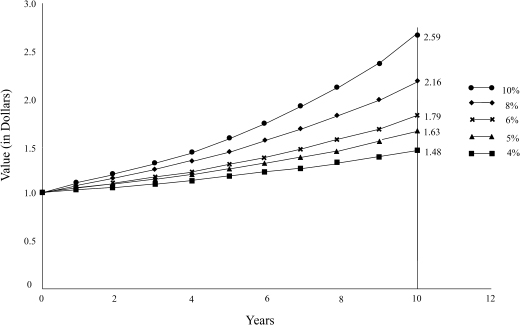

- Tables of Future Values of Present Amounts 479

- The “Present Value” of a Future Amount, the “Principal” or “Maturity Value” 481

- The Rule of Seventy-Two Is a Convenient Quick Aid 484

- Questions and Meditations 484

- 31 Series of Future Values and Annuities 490

- Annuity: Present Capital Value of a Series of Future Values 490

- Table of Present Values of Annuities 491

- The Low-Interest-Rate Bias 492

- Perpetuities—A Special Constant Annuity, Lasting Forever 493

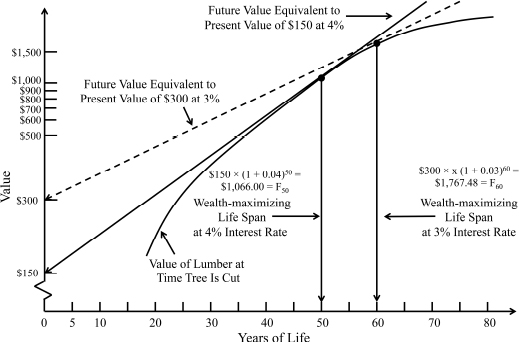

- A Distant Future Service’s Contribution to Present Capital Value 493

- How Large Is a Gift? 494

- Present Values of Annuities of Varied Annual Future Amounts 494 Edition: current; Page: [xviii]

- Honor Thy Father and Thy Mother 494

- Current Actions, Long-Run Effects, and Immediate Changes in Prices 495

- The Words in Financial Markets: Lending Is “Buying” and Borrowing Is “Selling” 495

- The Significance of Interest as a Cost—Even Without Debts 496

- If the Interest Rate Is 7 Percent 498

- Some Hidden Presumptions Deserving Suspicion 498

- Questions and Meditations 499

- Appendix to Chapter 31: Applications of Capital Value Principles 502

- Questions and Meditations 509

- 32 Wealth, Income, and Interest 516

- 33 A Package Called the Rate of Interest 532

- The Nominal and the Pure Rate of Interest 532

- Premiums in the Package Called the Nominal Interest Rate 532

- Add-Ons Specific to Individuals 533

- The Market Risk: Economy-Wide Factors for All People and Financial Securities 534

- Liquidity: A Subtraction in the Nominal Money Interest Rate Package 536

- Very Short-Term Bonds Have More Liquidity and Smaller Market Risk Than Longer-Term Bonds 536

- The “Real” versus the Realized Real Rate of Interest 536

- Can Not Reliably Measure the Rate of Interest by Relative Prices of Resources 538

- Investment Effects of Changes in Resource Prices, Rather Than in Cost of Borrowing 539

- Competitive Equalizing of Pure Interest Rates on All Bonds and Resources 539

- Questions and Meditations 539

- 34 Risk and Insurance 543

- Loss Spreading for Reduction of Private Loss 543

- What Kind of Catastrophes Are Insurable? 544

- Some Necessary Conditions for Voluntary Insurance 545

- Moral Hazard of Employee Behavior 548

- What Else Do You Get When You Buy Insurance? 548

- Insurance That Was Not Insurance 549

- Transformation of Insurance to Damage Compensation 550

- Relief from Losses Is Not the Sole Purpose of Insurance 550

- Lotteries—Increased Risk 551 Edition: current; Page: [xix]

- Insurance, Assurance, and Gambling: A Play on Words? 551

- Questions and Meditations 552

- Appendix to Chapter 34: Viable Insurance 556

- 35 The Full Equilibrium: Equalized Rates of Return with Intermediaries 558

- Elimination of Sure-Profit Arbitrage 558

- Unbiased Estimator 559

- News, Not Events, Is Random and Always Surprises 559

- Risk 560

- Trade-Off between Mean and Variance 560

- Random Walk: The Path of Successive Prices—Martingales 562

- An Efficient Market Portfolio 564

- Specialization and Intermediation in the Capital Markets 565

- Questions and Meditations 567

- 36 Determinants of the Interest Rate 571

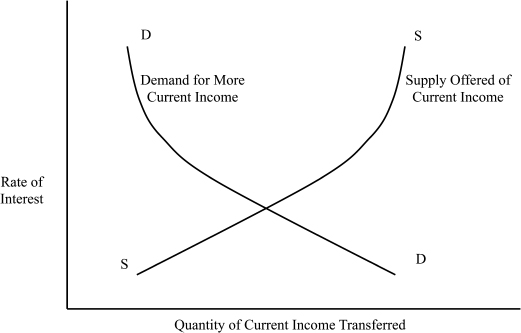

- Demand for More Current Income Relative to Future Income 571

- The Price of Current Income: The Rate of Interest 571

- Whether for Consumption or Investment Is Not Pertinent 573

- The Supply of Current Relative to Future Income 573

- Borrowing Is Selling Future Income; Lending Is Buying Future Income 574

- The Markets for Current Income Relative to Future Income 574

- Adjustments in Prices of Resources 576

- The Money Supply and the Interest Rate 577

- The Language of Buying and Selling Money—Instead of Lending and Borrowing Income 577

- Lending, Borrowing, or Renting? 577

- When Is the Rent Paid? 578

- Changing the Supply of Money to Affect the Rate of Interest 579

- Increasing the Money Supply Randomly 579

- Increasing the Money Supply by Purchasing Bonds 579

- Questions and Meditations 580

- 37 Futures Markets 586

- Control and Smoothing of Consumption between Harvests 586

- Hedges 587

- What Is a Futures Contract? 588

- Example of Hedging against Changes in the Price of Wheat 588

- The Seller of the Futures Contract 589

- Structure of Futures Contracts and Intermediaries 589

- Gamblers in Futures Contract Markets? 590

- Example of a Foreign Exchange Futures Contract 590

- What Determines the Price of the Futures Contract? 591

- Predictor of the Price in the Future 591

- Variety of Futures Markets 592

- Price-Forecasting Errors and Risks in Futures Markets 594

- Questions and Meditations 595

- 30 Arithmetic of Capital Values 475

- part four: Employment and Inflation

- 38 Unemployment: What and Why 603

- Search for Best Job in a World of Changing Tastes, Demands, and Capabilities 604

- Unemployment Insurance of Nonhuman Resources 606

- Job Creation: The Nonsense of Creating Jobs to Reduce Unemployment 606

- Creative Destruction 607

- New Entrants to Labor Force 607

- A Meaning of the Measured Rate of Unemployment 607

- Transition to and from the Market Labor Force and to and from Employment and Unemployment 608

- Personal and Gender Differences in Unemployment Rates 609

- Spells of Unemployment or Reduced Employment 609

- A Rise of Nonrecession Normal Rate of Unemployment: Changed Composition and Unemployment Benefits 609

- Unemployment—A Beneficial Phenomenon? 610

- Questions and Meditations 611

- 39 Your Earnings: How and When 614

- Full Earnings versus Money Earnings 614

- Tying Earnings to Performance: Pay Later When Worth of the Work Is Known 615

- Pitfalls in Perceptions of How Much Everyone Else Earns 618

- Age-Related Annual Earnings versus Total Lifetime Earnings 619

- Shifting Demand and Supply 619

- Ricardian Superiority 620

- Sensitivity of Earnings to Differences in Talent 620

- Why Large-Firm CEOs Earn More Than Small-Firm CEOs 620

- Replicability of Services Concentrates Rewards to the Best of the Competitors 621

- Prize for Being the Best 621

- Gender-Related Earnings 622

- Human and Nonhuman Wealth 622

- Poverty 623

- Nonmoney Forms of Income and Aid 623

- Poverty, How Long? Transitions to and from Poverty Status 623

- Feminization of Poverty? 624

- Questions and Meditations 624

- 40 Labor-Market Coalitions 628

- History and Organization 628

- Rise of Unions 629

- The National Labor Relations Board (NLRB) 630

- Union Objectives via Monopoly Status 631

- Labor Union Effects on Wages 631

- Protection from Employer Opportunistic Expropriation 632

- How Does Unionization Achieve Its Objectives? 632 Edition: current; Page: [xxi]

- Selective Monopolization: Labor and Wage Effects 634

- Why Do Private Employers Resist Unionization? 635

- Difficulty of Maintaining Contrived Monopoly Rent: The Value of Monopoly Rent Is Competed Away Even If Price and Supply Are Effectively Controlled 636

- Closed-Market Monopsonies of Buyers of Labor 637

- Questions and Meditations 638

- 41 Labor-Market Constraints 644

- Minimum Legal Wages or Living Wage 644

- Nonmoney Productivity and Nonmoney Components of Full Wages 645

- Substitution by Demanders of Labor Services 646

- Other Motives for Advocating Higher Minimum Legal Wage Rates 646

- Equal Pay for Equal Work 647

- Fair Employment Laws 647

- Legislatively Mandated Benefits 648

- Examples of Evidence of the Deduced Implications 649

- Why Would Employees or Employers Object to Mandated Benefits? 650

- Comparable Worth as a Basis of Wage Rates? 650

- Questions and Meditations 651

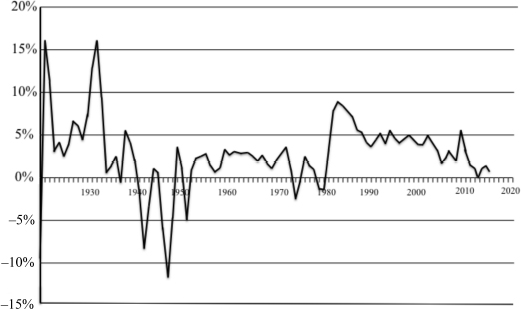

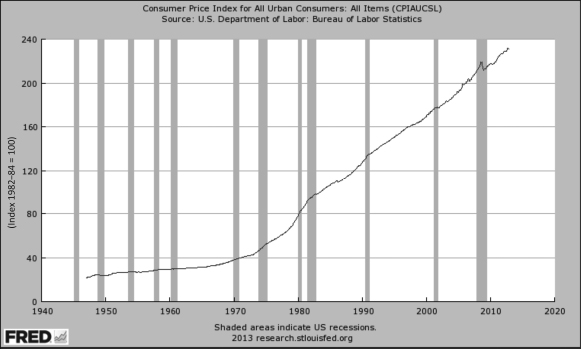

- 42 Money, Prices, and Inflation 657

- Money and Prices 657

- Inflation 658

- How Is Inflation Measured? 660

- The Cause of Inflation 660

- The Cause of the Increased Money Supply 662

- How Inflation Is Disruptive and Confusing 663

- Mistaken Beliefs about Causes of Inflation 664

- Wealth Transfers by Inflation 665

- Why Lend If Inflation Is Expected? 667

- Interpersonal Wealth Transfers as a Result of Incorrectly Anticipated Inflation 667

- Summary 668

- Questions and Meditations 668

- Appendix A to Chapter 42: Adapting to Inflation 674

- Appendix B to Chapter 42: Generalization of Interpersonal Wealth 676

- 38 Unemployment: What and Why 603

- Glossary 681

- Index 693

FOREWORD

Living is an important activity. And in a world of limitations—faced with scarcities of talent and character and iron ore—living is also difficult. Alternatives must be compared, analyses have to be conducted, decisions inevitably are required. And we often complicate our situation further with personal peculiarities and social arrangements which unduly increase the costs and dilute the rewards of our existence.

Various sorts of observers and self-appointed counselors—theologians, poets, philosophers—have long worked to resolve some of the bittersweet mystery of life. And now we are blessed with economists.

Aristotle, over twenty-four centuries ago, was the most conspicuous of the meditators of antiquity to devote considerable attention to selected aspects of economic conditions and activity. Adam Smith, in the eighteenth century, is the acknowledged father figure in the early development of modern economics. Something resembling current theory began to take shape with the Marginalist Revolution of nearly 150 years ago. A veritable golden age waxed—and perhaps then waned in some respects—in the second half of the twentieth century. In this post–World War II era, there was a considerable band of innovative theorists and applicators of fruitful analytics. Few of these elite were as useful as Armen A. Alchian.

Useful economics relies conspicuously on a toolkit of formal analytic techniques. But tools must be manipulated by competent carpenters. And the carpenters follow building plans prepared by imaginative, inspired, broadly sophisticated architects. Alchian was a master craftsman and contributed additional tools to the kit. And he has been a striking architect. Most rarely, he was anointed with feel for and sense of the nature of individuals and their societies and the mechanisms of the economy on which a community is founded. Further, like many other stalwarts of the economics fraternity, he was motivated to teach.

Milton Friedman observed that “some have a natural instinct for economics and the economic way of reasoning,” but “for most, economic reasoning is an acquired skill—and taste.” Alchian helped a long stream of talented students to acquire productive skills—and sophisticated intellectual tastes.

A spectacular technical, bravura scholarly exhibition often will be of little Edition: current; Page: [xxiv] value to the general community. A conspicuous Alchian characteristic has been to explain important matters in the most simple manner, and he was ingenious in solving questions with use of only the most basic conceptions and constructs. Mark Twain noted that his wife, living along the Mississippi River, learned all the swear words—but not how to carry the tune. In economic analysis, Alchian knew the words well and also splendidly hummed the tune.

Useful economists have learned that elemental, even elementary, economic tools in the hands of an accomplished scholar, teacher, and practitioner can be highly productive. Alain A. Enthoven, while working at the highest levels of policymaking in the Department of Defense, reported: “the tools of analysis that we [in Defense] use are the simplest, most fundamental concepts of economic theory, combined with the simplest quantitative methods. The requirements for success in this line of work are a thorough understanding of and, if you like, belief in the relevance of such concepts as marginal products and marginal costs, and an ability to discover the marginal products and costs in complex situations, combined with a good quantitative sense. The economic theory we are using is the theory most of us learned as sophomores.” (Economic Analysis in the Department of Defense, American Economic Review, LIII [May 1963], 422.)

Armen and I became UCLA colleagues in 1952. We have collaborated in several ventures, primarily in writing University Economics (Wadsworth Publishing Co., 1964, 1967, 1972) and Exchange and Production (Wadsworth Publishing Co., 1969, 1977, 1983). This is a new volume, although it bears family resemblance to its predecessors. Like Exchange and Production, it is essentially price-and-allocation analysis, along with consideration of inflation and various references to the applicability of microeconomics to the aggregate economy and international implications. Above all, it continues the effort of the earlier volumes to present an exposition of economic analysis with persistent emphasis on empirical validity and meaningfulness. The original manuscript was prepared by Armen over the course of a decade, before deteriorating health ended further work, preventing a polished exposition. Now, belatedly, the draft has been completed, edited, and updated.

Bringing Armen’s last project to fruition has required considerable and varied effort. It would not have been completed—if attempted, at all—without Jerry Jordan. Jerry was among a substantial flow of graduate students who were definitively influenced by Armen from the 1950s through the 1980s, and, like many of them, he has had a highly distinguished and conspicuous economics career. Along with prodigious work directly on the manuscript, he has been Edition: current; Page: [xxv] the chief coordinator of the variety of activities by several people involved in producing such a large publication.

Many scholars across the world, affiliated formally or informally with the UCLA Department of Economics in the Alchian era, have taken an interest in the publication and contributed to the project. Linda Kleiger, another of Alchian’s students, has done much both as an administrator and a critic of content. Arline Alchian and Daniel Benjamin preserved the original manuscript and made it available to Jerry and me. Ben Zycher, Courtney Clifford Stone, Rachael Balbach, W. Lee Hoskins, Ken Clarkson, Zhaofeng Xue, and Kam-Ming Wan are among those who have provided guidance and encouragement. Michael Pistone aided greatly in preparing the diagrams and tables; Tsvetelin Tsonevski reformatted the entire manuscript. All who contributed to preparation of the manuscript are gratified that Liberty Fund has committed resources—most of all the time and talents of Laura Goetz, Senior Editor—and prestige to making available this final component of Armen’s legacy.

Armen Alchian—a colleague, mentor, coauthor, and virtual older brother of mine—left us, at age ninety-eight, in February 2013.